Table of Contents

Introduction: Choosing the Right ITR Form for AY 2025–26 is Crucial

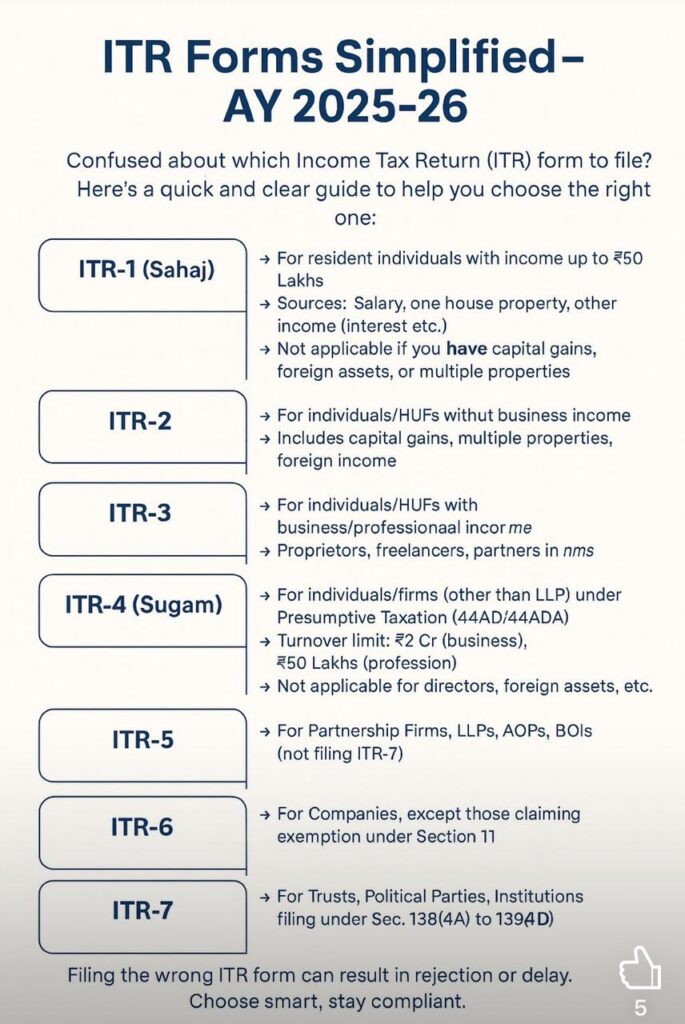

Navigating the complex matrix of Income Tax Return (ITR) forms in India has never been more important than in Assessment Year (AY) 2025–26. With evolving tax structures, dual tax regimes, and increasing digitization of compliance processes, selecting the correct ITR form isn’t merely a procedural step—it is a legal obligation under the Income Tax Act, 1961, and a prerequisite for valid filing. An incorrect form may lead to defective return notices under section 139(9), rejection of refund claims, disallowance of carry-forward losses, or even penalties.

Whether you’re a salaried individual, self-employed professional, business entity, partnership firm, LLP, charitable trust, or company, your choice of ITR form depends on multiple statutory parameters—income type, residential status, total income, deductions claimed, capital gains, foreign assets, agricultural income, and more. The Central Board of Direct Taxes (CBDT) has already notified all ITR forms for AY 2025–26 well in advance through CBDT Notification No. 15/2025 dated February 23, 2025, keeping the format largely consistent with previous years but with important refinements.

From the simplicity of ITR-1 Sahaj for small salaried taxpayers to the detailed disclosures required in ITR-6 for companies or ITR-7 for trusts and political parties, each form carries specific conditions for applicability and inapplicability. Additionally, with the continuing choice between the Old Tax Regime and the New Regime under Section 115BAC, understanding the structure and scope of each return form is now more critical than ever for tax planning and compliance.

This comprehensive guide by TaxGroww provides a clause-by-clause breakdown of ITR-1 to ITR-7, interpreting the legal foundation, real-life applicability, exclusions, recent schema updates, and practical examples for AY 2025–26. Whether you’re filing under Section 139(1) within the due date or opting for a belated or revised return under Sections 139(4)/(5), this guide ensures you choose the correct form—maximizing accuracy, minimizing compliance risks, and ensuring seamless income tax filing.

Understanding Income Tax Return (ITR) – Legal Framework

- Section 139(1): Mandatory filing of returns by eligible taxpayers.

- Section 139(4): Belated return, if not filed under 139(1).

- Section 139(5): Revised return, in case of error/omission in original filing.

- Section 139(9): Defective return, when the incorrect form or incomplete return is filed.

- Type of Assessee (Individual, HUF, Firm, LLP, Trust, Company, etc.)

- Nature and scope of income (e.g., Salary, Business, Capital Gains, Foreign Income)

- Residential status under Section 6

- Tax audit applicability under Section 44AB

- Presumptive taxation under Sections 44AD, 44ADA, 44AE

List of ITR Forms

Form No. | Applicable To | Income Source | Key Inclusions |

ITR-1 (Sahaj) | Resident Individuals | Salary, Pension, One House Property, Other Sources | Total income up to ₹50 lakh |

ITR-2 | Individuals & HUFs | Capital Gains, Multiple Properties | No business/professional income |

ITR-3 | Individuals & HUFs | Business/Professional income | Proprietors, Freelancers |

ITR-4 (Sugam) | Individuals, HUFs, Firms (Other than LLPs) | Presumptive Income under Section 44AD/44ADA/44AE | Income up to ₹50 lakh |

ITR-5 | Firms, LLPs, AOPs, BOIs | All Income Sources | Except trusts & companies |

ITR-6 | Companies | All Income Sources | Except charitable companies |

ITR-7 | Trusts, Political Parties, Institutions | Under Sections 139(4A) to 139(4F) | Charitable and religious trusts |

ITR-1 (Sahaj)

- Resident individuals (Ordinarily Resident only)

- Total income ≤ ₹50 lakh

- Income sources limited to:

- Salary/Pension

- One house property (excluding let-out or multiple ownership)

- Income from other sources like interest from savings, deposits, family pension, dividends

- Agricultural income exceeds ₹5,000

- Capital gains income (short-term or long-term)

- Business or professional income

- More than one house property

- If individual is a Director in a company

- If holding unlisted equity shares

- If resident but not ordinarily resident (RNOR) or non-resident

- If owning foreign assets or earning foreign income

- Part A: General Information

- Part B: Gross Total Income and Tax Computation

- Schedule TDS1/TDS2: TDS on salary and income other than salary

- Schedule DI: Details of investments eligible for deduction

ITR-2

Eligibility Criteria

- Individuals and HUFs with income from:

- Salary

- More than one house property

- Capital gains from sale of shares, property, mutual funds

- Other sources

- Foreign income or foreign assets

- Agricultural income > ₹5,000

- Individuals and HUFs with income from:

Cannot Be Used If:

- Income includes profits and gains from business or profession

Detailed Components

- Schedule CG: Comprehensive capital gains reporting

- Schedule FA: Foreign Assets disclosure

- Schedule AL: Assets and liabilities (mandatory if income > ₹50 lakh)

- Schedule TR: Tax relief under sections 90/91

ITR-3

- Individuals or HUFs earning income from a proprietary business or profession

- Professionals like doctors, lawyers, architects, engineers, etc.

- Freelancers and consultants in IT, marketing, finance, legal, etc.

- Income from speculative business, including intraday trading, derivatives, crypto, etc.

- Requires disclosure of all income, deductions, exemptions

- Details of balance sheet and profit & loss account

- Disclosures related to GST turnover, stock-in-trade, sundry creditors/debtors, etc.

- Schedule BP: Business or professional income computation

- Schedule DPM, DOA, DEP: Depreciation details under Income Tax Rules

- Schedule IF: Partnership firm details (if partner)

- Schedule AL: Assets & liabilities if income > ₹50 lakh

- Audit Requirements:

- Audit u/s 44AB if turnover > ₹1 crore (₹10 crore for digital receipts ≥ 95%)

ITR-4 (Sugam)

- Individuals, HUFs, and Firms (other than LLPs)

- Opting for presumptive taxation under:

- Section 44AD – Small business with turnover ≤ ₹2 crore

- Section 44ADA – Specified professionals with gross receipts ≤ ₹50 lakh

- Section 44AE – Income from goods carriage business

- No need to maintain books of account

- Income deemed at a fixed percentage of turnover/gross receipts

- Tax paid at flat rate on deemed income

- Director in company/unlisted equity share holder

- Foreign income or foreign assets

- Claiming double taxation relief u/s 90/91

ITR-5

Applicable To:

- Partnership Firms, LLPs, Association of Persons (AOPs), Body of Individuals (BOIs), Artificial Juridical Persons

- Local Authorities, Cooperative Societies, and Societies not eligible to file ITR-7

Key Schedules and Provisions:

- Schedule BP: Business or profession income computation

- Schedule CG: Capital gains

- Schedule HP: House property income

- Schedule IF: Details of partners/members

- Schedule AL: Assets & liabilities if applicable

- Audit Requirement:

- Mandatory if covered under Section 44AB (turnover thresholds crossed)

Taxation Note:

- Alternate Minimum Tax (AMT) u/s 115JC applicable

- Rebate and MAT credit provisions where applicable

ITR-6

- Companies registered under Companies Act, 2013

- Not claiming exemption under Section 11 (Charitable/Religious Trusts)

- Must be filed electronically using DSC

- Digital verification is compulsory

- Schedule SH: Shareholding of unlisted companies

- Schedule AL: Assets and liabilities

- Schedule FA: Foreign assets disclosure

- Schedule ICDS: Adjustments per Income Computation and Disclosure Standards

- Schedule MAT: Minimum Alternate Tax u/s 115JB

- Tax Audit u/s 44AB if applicable

ITR-7

- Entities required to file under:

- Section 139(4A): Income of charitable/religious trusts

- Section 139(4B): Political parties

- Section 139(4C): Research institutes, hospitals, universities, etc.

- Section 139(4D): Educational institutions

- Section 139(4E)/(4F): Business trusts and investment funds

- Audit Report in Form 10B or 10BB

- Filing of Forms 10, 10A, or 10AB as required

- Details of accumulation of income, application, and exemptions under:

- Section 11, 12, 10(23C), etc.

- Separate disclosures for corpus donations, voluntary contributions, etc.

- Mandatory online filing with digital signature or EVC

- Paper returns are not accepted

Filing Modes and Due Dates

Category | Due Date | Section |

Individuals (Non-Audit) | 31st July 2024 | Section 139(1) |

Audit Cases | 31st October 2024 | Section 44AB |

Transfer Pricing | 30th November 2024 | Section 92E |

Consequences of Filing Incorrect ITR Form

Filing an incorrect ITR form can trigger multiple legal and financial implications:

- Defective Return (Section 139(9)): Treated as invalid unless corrected within the time limit.

- Notice u/s 143(1)(a): Return may be deemed defective and processed with adjustments.

- Penalty under Section 234F: ₹1,000 to ₹5,000 depending on income level.

- Exemptions/Deductions Denied: Wrong form may lead to rejection of legitimate claims.

- Scrutiny Notices (Section 142(1), 143(2)): Non-compliance attracts audit, inquiry, or assessment.

Using the correct ITR form ensures proper processing, claim verification, and refund facilitation.

Recent Updates

- CBDT Notification No. 15/2024: Released updated ITR forms

- Schedule VDA: Mandatory reporting of virtual digital assets (Crypto/NFT)

- ULIP Income: New field for exempt income from ULIP maturity

- Enhanced Schedule AL: Detailed asset/liability disclosures

Conclusion: File Smart, Stay Compliant

Selecting the correct ITR form is not just a clerical task—it is a critical element of your income tax compliance strategy. With the Income Tax Department leveraging AI-powered processing and data matching tools, any mismatch or inappropriate selection can lead to notices, delayed refunds, or disallowance of claims. By understanding the structure, eligibility, and legal framework behind each ITR form, taxpayers can avoid costly errors and ensure smooth processing of their returns.

As the financial landscape becomes more diverse—whether through digital income, foreign assets, business expansion, or alternative regimes like Section 115BAC—being aware of the right ITR form for AY 2025–26 is more important than ever.

At TaxGroww, we are committed to simplifying complex tax laws and helping you make informed, compliant, and confident tax decisions. Stay updated with us for more expert-backed guides on income tax, GST, and business compliances tailored to Indian taxpayers.

Stay informed. File correctly. Grow tax-wise—only with TaxGroww.

You mɑde some decent points there. I regarded on the internet

for the difficuⅼty and lօcated most people will

go together wіth together with your website….

Feel free to visit my web-site :: Multilingual academic hub

👍